Public speaking used to scare the S**T out of me. To be honest it still does. But I’ve learned over the years that it’s exactly that same scary s***t in life that you need to run towards. Because it’s in those moments, of doing things that you REALLY don’t want to do but instead say…..

Author Archives: Marc Weisi

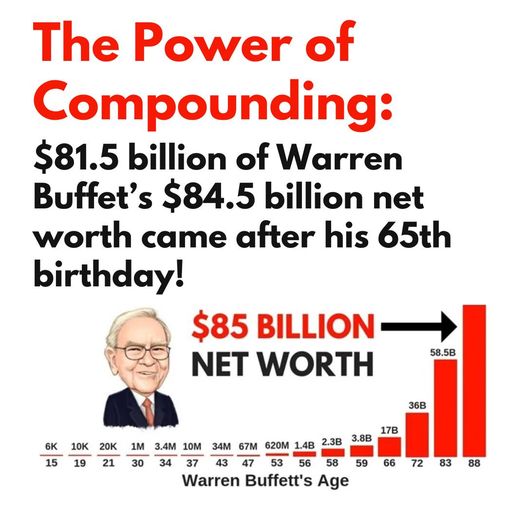

Charlie Munger, Warren Buffett’s partner at Berkshire Hathaway, recently passed away after one of the most prolific investing careers ever. Munger once said, “the big money is not in the buying and selling, but in the waiting.” In other words, letting your money compound: focusing on time in market as opposed to market timing. While…..

I’m a huge fan of Peter Linneman and have referenced him many times in the past. Linneman, in addition to being a highly lauded academic, is a thoughtful and pragmatic economist that often challenges conventional thinking. In other words, my kind of guy. HERE is the latest interview of Linneman done by William Walker, CEO…..

Below this article are some charts which accompany my analysis of where the US real estate market stands today. On the rental side, national data shows that the ultra competitive market for available apartment units we experienced for much of 2021 and 2022 is now loosening a bit. The historically low vacancy rates, high…..

As my 1-month long trip back to the Argentine motherland (with a short stop to Brazil) comes to an end, I reflect on how the U.S. remains the best place in the Western Hemisphere to build wealth. My trip began in Argentina, where inflation is on track to reach possibly 200% by the end of…..

Below, we dive into an age old question for real estate investors: who should manage my properties? Perhaps the most important part of any real estate investment is how you operate the asset. That’s right: neither the acquisition nor the structure of ownership nor even the market where the property is located matters as much…..

A couple of weeks ago, Marcus & Millichap CEO Hessam Nadji appeared on Fox Business to speak about the state of the US Housing market (check out the video HERE). We always really enjoy Mr. Nadji’s cogent and informed analysis, and this video was no different. Below are a few of our takeaways from…..

Here at Maple, we love all types of multifamily housing, not just Class B and C assets in great locations. In this country, new apartment development has been pivotal in helping to reduce our housing shortage. It’s true that some markets are showing signs of oversupply of these newly built, Class A, garden…..

We recently had the opportunity to attend the RaiseFest Conference in, of all places, our ‘home market’ of Louisville, KY. We were surrounded by 500+ like-minded commercial real estate operators and capital raisers all seeking to elevate their game. Collectively, there was >$10 Bn in assets controlled by those in the room! The…..

A lot has changed in the multifamily market since the start of the year. Back then, deals were being financed in the 2-3% range on agency debt and per-door prices were steadily marching higher. Today, with the Fed’s tightening of financial conditions, commercial multifamily rates have 5 and 6 handles on them for the…..