Below this article are some charts which accompany my analysis of where the US real estate market stands today.

- On the rental side, national data shows that the ultra competitive market for available apartment units we experienced for much of 2021 and 2022 is now loosening a bit. The historically low vacancy rates, high renewal rates (tenants re-signing leases at lease expiration), and crazy bidding that was commonplace in many markets seems to be moderating. To be sure though, the rental market is still tight by historical standards. Obviously this is national data so some markets may be tighter or looser than these numbers.

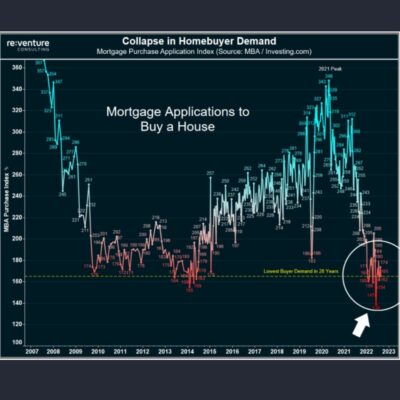

- On the purchasing side, home mortgage applications have fallen off a cliff as mortgage rates in the high 7% range have stymied some would-be homebuyers from buying at a time categorized by high valuations and limited on market inventory.

- For these would-be homebuyers, there’s never been a more attractive time to sit on the sidelines and wait. The gap between the cost to own a home and the cost to rent is $1,138/month! That means that it’s 52% more expensive to buy right now than rent!

- All of this bodes well for the consumer (70% of our economy), for housing, and most of all, for multifamily housing demand. This is why we believe right now is a great time to be invested in multifamily assets.