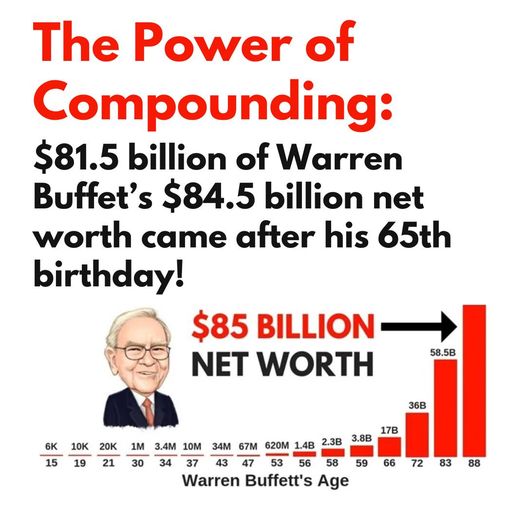

Charlie Munger, Warren Buffett’s partner at Berkshire Hathaway, recently passed away after one of the most prolific investing careers ever. Munger once said, “the big money is not in the buying and selling, but in the waiting.” In other words, letting your money compound: focusing on time in market as opposed to market timing. While Munger’s wisdom isn’t as widely cited as his partner’s, Buffett confirms this same wisdom: “My wealth has come from a combination of living in America, some lucky genes, and compound interest.” Thus, Buffett credits much of his net worth to the simple though powerful math of compounding.

Unfortunately, most investors aren’t patient/disciplined enough to follow this playbook (buy cash-flowing assets, reinvest the gains, and hold them long term), but history has proven that this is the surest way to build your net worth over time.