1. Forces you to treat the property as a business In real estate valuation, there’s a term called “highest and best use” which refers to a property/building’s most optimal use given its characteristics and location. As an investor, we apply that same concept to your time. An investor’s time should be focused on what they…..

Category Archives: investment

What Is A Syndication? “Helping Our Investors Reach Their Financial Goals Through Passive Real Estate Investing” -Maple Capital Partners Mission Statement At Maple Capital Partners, we take our mission statement very seriously. We aim to help investors understand how they can use passive real estate investing as a crucial part of their overall portfolio. We…..

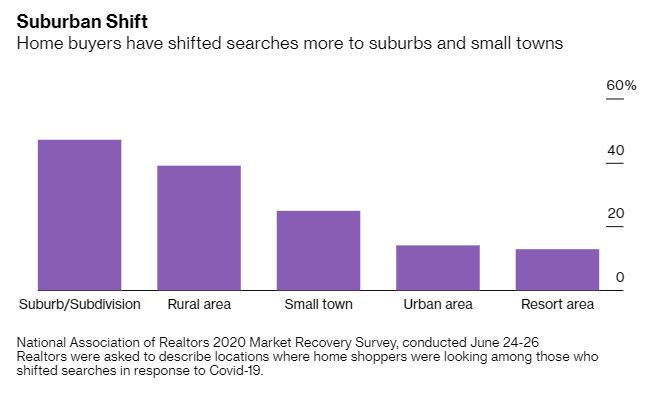

As investors in multifamily real estate assets, migration patterns matter to us. Where the population is moving is one of the most important factors we look at in choosing markets in which to invest. Sidenote: for the other factors we look at when choosing markets, check out a piece we put out on this very…..

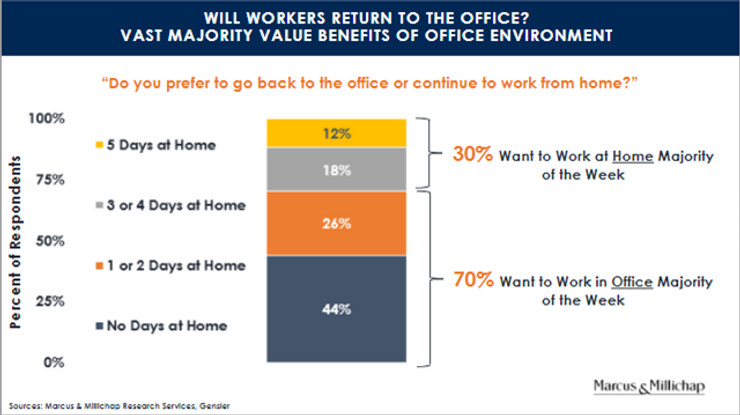

Suburbanization As anyone who has recently looked at a house in New York city’s suburbs can tell you, sales activity, a shortage of available listings, and competitive bidding have all increased substantially in the past few months. Not surprisingly, single-family home prices have shot up: a clear beneficiary of COVID-19’s shelter-in-place restrictions. Being that most…..

Reason #1: In residential (1-4 units), vacancy is a returns killer. Reason #2: Commercial multifamily holds up well in recessions. Reason #3: Operating expenses are typically lower/unit in CMFR Reason #4: Economies of scale make CMFR more passive-like investments Reason #5: CMFR value is more within your control than Residential value Reason #6: Attractive financing…..