As interesting as real estate is, we would be remiss if we didn’t mention Ukraine. Many of our friends and family members are looking for ways to support Ukrainian people on the ground rather than through a large NGO. Our friend and fellow real estate investor Roman Malantchouk started the Friends of Chervonohrad relief effort to deliver…..

Category Archives: investment

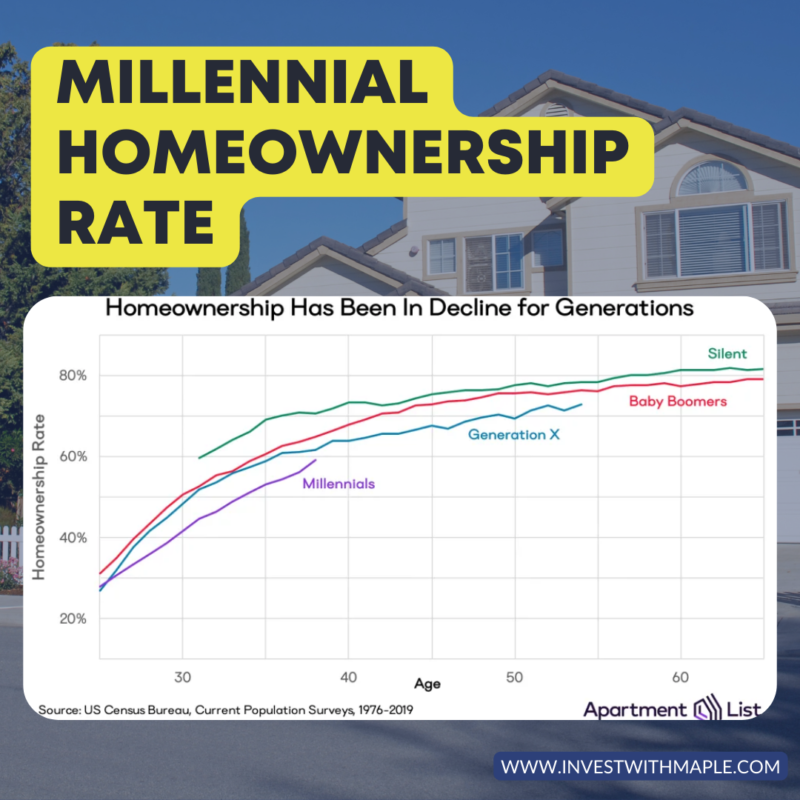

Declining rates of homeownership are nothing new, with each of the last 3 generations having a lower rate than the previous one. But why have home-ownership rates fallen so much for Millenials specifically? We believe that Millenials’ preference toward rentership can be attributed to 3 factors: They’ve been disillusioned by their experiences living through the…..

For anyone that knows Marc or Gonzalo, they can appreciate that their real estate journey has been anything but easy. As opposed to the podcast real estate moguls that start out investing and within a year have obtained millions and reached financial freedom, their story has been filled with more ups and downs than straight…..

People don’t buy what you do, they buy why you do it. Said another way, what you do simply serves as a proof for what you believe. What do Apple, the Orville Brothers, and Dr. Martin Luther King Jr. have in common? They are all leaders in/for their respective industry or cause who inspire the…..

We’ve arranged the following resources into the categories/factors that we’ve found to be the best determinants of the strength of a particular market. While there are many other factors and even sources of this information, these are the links that we’ve found most useful through our own research. Places to Get Started The below 3…..

Are Taxes A Choice? “In America, there are two tax systems; one for the informed and one for the uninformed. Both systems are legal. Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not…..

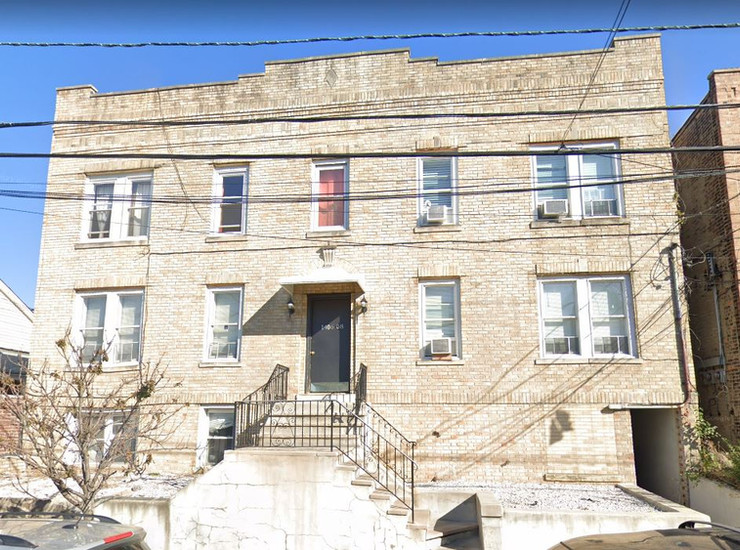

Some of our readers may be asking what lead us to multi-family. After all, for the past few years, Gonzalo and Marc have mostly specialized in buying, renovating, refinancing, and holding residential 1-2 family houses in the northern NJ area. Before we get into why we think commercial multifamily offers superior risk/reward characteristics, let’s define…..

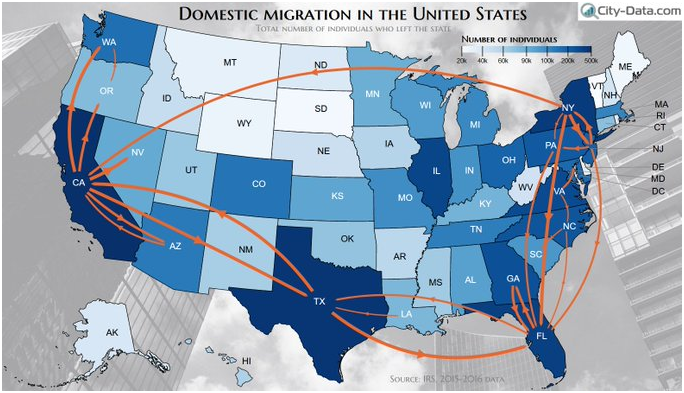

1. Go where people are going It’s not just birders that care about migration patterns anymore. This might seem self-evident but you need to go where tenants are going. Demographics matter because they help you gauge inherent demand. People move, populations swell, rental rates increase, generally speaking. The key though is sustainable growth. You don’t…..

In the below, we’ll delve into the top 10 metrics that all real estate investors should understand before investing a single penny in a deal. These are the metrics that we believe, once understood, best inform an investor’s decision to pull the trigger or not. 1. Cash-on-Cash Return (c-o-c) Cash-flow divided by cash invested. This…..

Real estate is a hyper localized asset class. What do we mean by this? While the talking heads on financial news outlets and Wall St. economists often refer to real estate as if it were a singular national market, seasoned real estate investors know better. Each market (or MSA as we call it) experiences its…..