Some of our readers may be asking what lead us to multi-family. After all, for the past few years, Gonzalo and Marc have mostly specialized in buying, renovating, refinancing, and holding residential 1-2 family houses in the northern NJ area. Before we get into why we think commercial multifamily offers superior risk/reward characteristics, let’s define commercial multi-family vs. residential real estate investments:

Residential: 1-4 units

Commercial multifamily: 5+ units

Now that that’s out of the way, let’s explore the top 5 reasons why we think commercial multifamily represents a superior asset class.

Reason #1: Vacancy is a returns killer!

As anyone who owns single-family (SFR) and small multi-family rental (SMFR) properties knows, vacancy is the largest expense that an owner/operator has to contend with. Forget taxes, insurance, and even to some degree operating expenses, vacancies and the cost of turning the units to make them ready is a virtual Carol Baskin to your bottom line (apologies for the controversial Tiger King reference–we’ve been cooped up for 3 months). When you own a SFR, losing a tenant for 2 weeks means you’ve lost 100% of your gross income for that period. Now suppose you own a 100-unit apartment complex. 1, 2, or even 10 vacancies still means a modest decline to your top line, relatively speaking. You can most likely cover the debt and still even generate some cash-flow at those levels. We over at MCP call this diversification of tenant risk and it’s a great way to protect your top line (rental income) as an investor.

Reason #2: Commercial multifamily holds up well in recessions

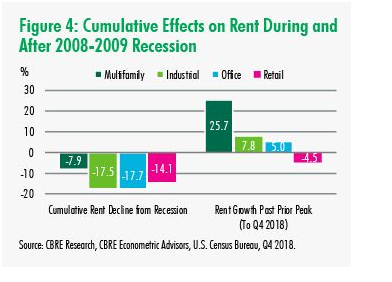

While we’d caution against any investment being thought of as fully recession-proof, what we do know is that commercial multifamily rental (CMFR) assets performed better than all other real estate assets classes in the recession of 2008-09. From CBRE, “Multifamily rents have outperformed those of the other major property sectors during and after the 2008-2009 recession in three ways. The sector experienced the lowest level of rent decline, the fastest recovery to pre-recession peaks and the longest post-recession period of rent growth.” See figure 4 below for the data behind this assertion. This all makes sense intuitively. If you’re familiar with Maslow’s ‘Hierarchy of Needs’, shelter falls right along with food, air, and water as the most important needs in human lives. Given that multifamily apartments are usually the more affordable option to renters vs. comparable single-family rentals, it makes sense that tenants generally would place paying rents as pretty high in their budget priorities even during economic downturns.

Reason #3: Operating expenses are typically lower per unit

Whether you’re investing in single family and small multifamily properties or commercial (5+) multifamily real estate, there are certain expenses that are absolutely necessary as you scale your real estate portfolio. Examples include repairing a roof(s) or foundation(s) every so often, providing landscaping at your properties, and hiring property management. This is where scale truly benefits the CMFR investor. Because you have more units under one roof, much of your fixed costs are spread out over more units. Also, certain service providers (such as property managers) will provide cheaper pricing as the number of units they service goes up. For example, a PM on a duplex might charge 10% in your area, but to manage 20 units they likely would be markedly cheaper. This translates to lower fixed costs/unit and drives net income higher on CMFR vs. SFR/SMFR assets.

Reason #4: Economies of scale makes commercial assets more passive-like investments

As Gonzalo and Marc have learned over the past few years, managing SFR’s and SMFR’s is very much hands on until you can afford a property management company to handle the day-to-day operations. This includes things like dealing w/ non-paying tenants, coordinating showings and leasing with new tenants, hiring repairmen or even getting your own hands dirty for minor maintenance, etc. All of which are exhausting and none of which related to our core competencies as first and foremost investors. Unless you enjoy this stuff, self-managing a portfolio of SFR’s and SMFR’s can be thought of somewhat akin to partnering up in business with Joe Exotic–just plain dumb. Okay, last Tiger King reference… we promise. Fortunately, in the CMFR space, there are enough units to warrant paying full-time, on-site management of the property. This means you now have professional boots on the ground to handle a lot of these issues for you. Pick a good property manager and they can actually increase the profitability of the asset even after adding their fee to your operating budget. Now that’s call smart business! While hiring a property manager doesn’t totally alleviate all of your headaches, it definitely takes most of the burden off of your shoulders, freeing you up to do whatever it is you do with your free-time. That’s none of our business, weirdo.

Reason #5: CMFR value is more within your control than SFR value

Anyone that lived and owned residential real estate through the ’08 financial crisis knows what it’s like feel totally out of control of the value of their asset. Whether it was your primary home, a small rental property investment, or vacation home, people were surprised learn that their assets had declined as much as 50% in some parts of the country. This illustrates the point that in residential real estate, assets are valued based on comparable properties. That is, your home would be valued based on homes in your neighborhood with similar characteristics that are for sale and have sold recently. Unfortunately, what your crazy neighbor Tom (no offense to my crazy neighbor Tom) decides to do with his property will almost certainly affect what you’re able to fetch if you decide to sell your home. However, in the CMFR space, assets are valued like one would value a business–based on profitability. More accurately, the property’s net operating income. This means that much of the value of the property is well within your control. The more you’re able to drive net income higher, all else being equal, the more your asset is worth. Awesome, right? We think so too.