Suburbanization

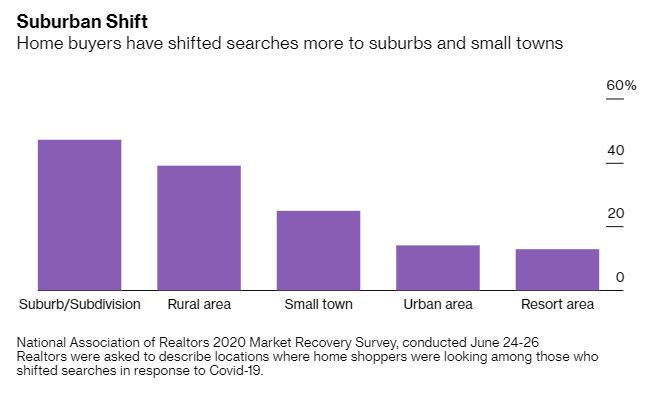

As anyone who has recently looked at a house in New York city’s suburbs can tell you, sales activity, a shortage of available listings, and competitive bidding have all increased substantially in the past few months. Not surprisingly, single-family home prices have shot up: a clear beneficiary of COVID-19’s shelter-in-place restrictions. Being that most of the main draws of cities (restaurants, museums, sporting events, concerts, nightclubs, etc.) are shuttered, dense city living is simply less attractive to some these days. The below are a few other contributing factors supporting this trend:

-

Older millennials that are getting married and having children (a trend that was in place even pre-pandemic)

-

The pent-up demand from the spring selling season that was delayed due to the shelter-in-place restrictions

-

Exceptionally low mortgage rates stimulating loan demand

-

Remote working requiring more space than a traditional city apartment

Now, don’t get us wrong: unlike many TV pundits calling for the demise of most major cities across the nation, we don’t believe that the allure of city life has permanently worn off. We belief that dense cities will ultimately see most residents return, especially once a vaccine is available and social-distancing no longer necessary.

Migration to More Affordable States/Locales

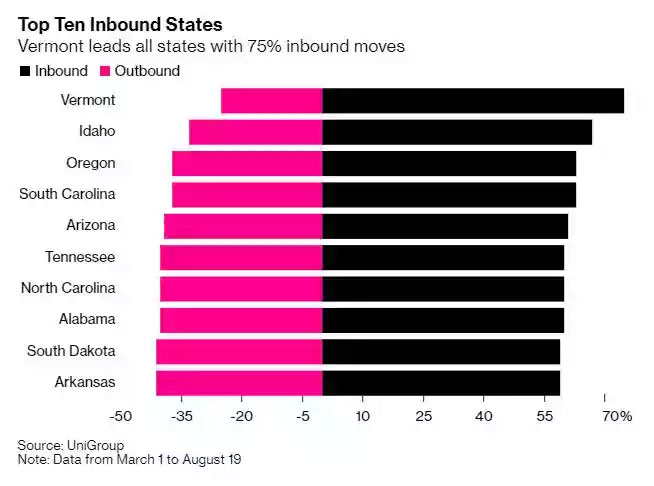

Given that a massive 42% of the US labor force is working from home today, we believe that it’s only a matter of time before those with the means to do so will migrate from higher-cost areas to lower-cost ones. For a worker who is working full-time remotely, this may mean ditching high-tax, high cost of living Boston, New York, or San Francisco for lower-tax, lower cost of living locales like Atlanta, Charleston, or Nashville. In addition to low taxes and low cost of real estate, we believe the following will be large considerations for remote workers with the flexibility to migrate:

-

Weather/climate

-

More business- and regulatory-friendly environments (tend to coincide w/ strong job markets)

-

Better fiscal outlooks (tends to coincide w/ lower expected future taxes)

What a coincidence! Some of these are the very same factors that we pointed out in our article on “How to Select a Target Market for Real Estate Investment.” It’s no surprise that many of the regions that get good grades on all of these factors are the very same markets we’ve long been fans of, particularly those in the Sunbelt.

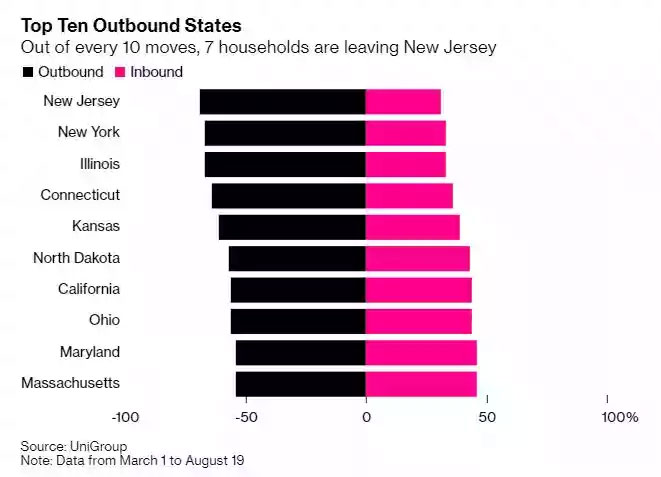

Worth noting is the fact that cities and states like the below that suffer large population losses may have a long road ahead. That’s because the people leaving take with them income and thus much-needed taxes. A significant population loss would mean states would either have to cut services (not politically palatable in most areas) or raise taxes to meet their obligations. This could kick off a vicious spiral of population out-migration leading to strains on fiscal and operating budgets followed by tax increases leading to further out-migration and so on and so on. Not a scenario any real estate investor wants to deal with.

Re-shuffling of Select Real Estate Sectors

We believe that retail, office, and industrial are the sectors that will change the most as a result of the pandemic. Not surprisingly, multifamily should hold up relatively well. Our thoughts below.

-

Industrial (the good): Perhaps the greatest winner outside of single-family homes, warehouses and distribution centers are growing at a staggering pace. The reliance of consumers on e-commerce during quarantine has only propelled this longstanding trend even faster. We believe that this trend will continue as traditional brick-and-mortar retail giants like Walmart shift more of their focus to the online channel.

-

Office (the bad): Despite the overblown headlines in the media, we believe that the office market isn’t completely dead and that many workers will eventually get back to working from the office in some capacity. That said, one reasonably likely outcome would be that companies employ a hub-and-spoke model where appropriate. That is, they might have some employees work remotely full-time, some part-time from suburban locations, and others return to a large, urban office building altogether. However, that doesn’t mean it’s all glitter and rainbows for urban office space. These changes would still result in much-reduced demand for square footage, companies embracing flexible office arrangements, and shorter duration leases. All spell trouble for the office sector. One bright spot is that there are already talks from some larger, national re-developers on the idea of converting existing office buildings to hybrid multifamily assets. This could pose an opportunity in particularly high-cost of housing metro’s.

-

Retail (the ugly): No surprise here. At one end of the spectrum you have mom-and-pop small businesses which have been among the hardest hit during this pandemic. These retailers don’t typically carry reserves to withstand months of depressed or non-existent sales and were already hurting due to Amazon’s ubiquity. In dense urban areas, these small businesses are usually wholly dependent on the daily flow of office workers and, as a result, have suffered doubly. At the other end of retail, large enclosed malls and experience-oriented retail have also suffered tremendously. Large retailer bankruptcies and store closures are accelerating. The future is unclear but shopping centers and malls will likely undergo very difficult times for the next few years.