1. Go where people are going

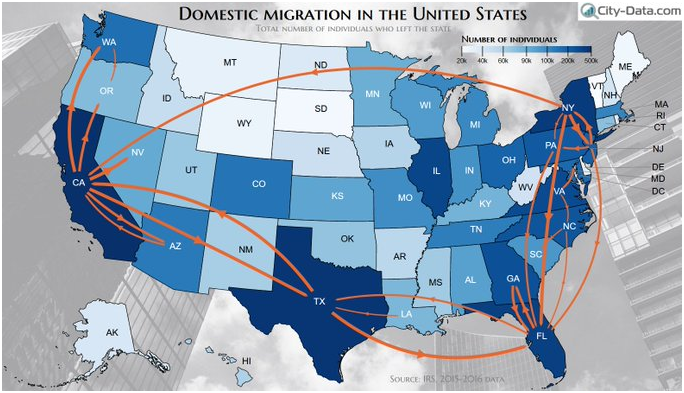

It’s not just birders that care about migration patterns anymore. This might seem self-evident but you need to go where tenants are going. Demographics matter because they help you gauge inherent demand. People move, populations swell, rental rates increase, generally speaking. The key though is sustainable growth. You don’t just want to invest in a market that’s shown one or two years of stellar growth due to factors that are not likely to continue. You want a market that’s demonstrated consistent growth over many years AND that’s unlikely to dissipate. For example, we look at a minimum 10 years of population data to determine whether we think this trend is sustainable. More importantly, you’re looking at the data to understand WHY those people moved, where they’re coming from, and if those factors are likely to continue into the future. For example, demographic trends over the past few years tell us that people are moving in droves from higher-tax states to lower-tax states, especially throughout the Sunbelt. This is a trend that only sped up with COVID-19. The rationale is both clear and sustainable, as it’s unlikely to change unless relative tax rates do.

2. Go where jobs are going

Renters need jobs. As an investor, you want to know that your tenants live in a thriving local job market. For that, try HUD data as a first step here. Pay particular attention to the following: Are employers bringing jobs to the area? Are they jobs that your prospective tenants could likely fill? Keep in mind that not all jobs are created equal either. Retail jobs are generally more risky than healthcare jobs, so you’ll want to weigh them differently when evaluating markets. Ask yourself if these industries are likely to grow or are prone to disruption in the next few years. Also, look for employer/sector diversification. Single industry/employer towns can spell disaster. If the main employer is a nearby military base for example, and that base downsizes or is relocated, you’re going to be in a tough situation filling vacancies. Being highly exposed to a single industry is risky because your tenants will have very few options if that industry experiences a downturn or even becomes obsolete. Just ask Detroit. Nothing against Detroit of course– we’re big fans of your pizza, American muscle cars, and the “8 Mile” movie.

3. Go where it’s affordable

Cost of living is key. Look at where median wages stack up against average rents. If tenants are spending more than 30-40% of their income on rents, this not an affordable area and tenants will likely look to move elsewhere longer term. Not only that, but you wouldn’t want to rent to severely cost-burdened tenants as they’re less likely to have saved reserves and more likely to experience financial hardship than in more affordable areas. Also, if rents are very economical for tenants today, there may be more room to increase them over time. Aside from what percentage of their income rent represents, you’ll want to compare the price of renting to the price of home ownership locally. If it’s significantly cheaper for a potential tenant to buy their own house vs. renting from you, it’ll be very difficult to attract quality tenants as they’ll all be vying for home-ownership.

4. Go where there isn’t much supply coming

The above 3 points are primarily factors that drive demand for housing. They are great indicators, but alone they paint an incomplete picture. We must weigh those indicators against the supply of homes being produced to get the full story. It’s one thing if there’s demand for 100k new units in a particular market over the next year, but what about if they’re producing 250k units to be completed by then? That could have a major impact on occupancy and rent rates that existing housing could command 1 year from now. More supply than demand means that rents have to adjust downward and vacancy upward, all else equal. That is because, when new product hits the market and it’s designed for the same tenant base as you’re competing for, your tenants now have more and better (it’s new after all) options. On the other hand, less building/supply = less competition for your units. If you’re not sure where you can find projected supply information, please don’t hesitate to contact us for the data sources we use.

5. Go where you’re appreciated

Last but definitely not least, you want to invest where your capital is appreciated. Choose areas with relatively low taxes and a real estate/business-friendly environment. Property tax rates vary widely throughout the country so you’ll want to make sure that yours are as low as possible since this is one of the largest expense items on any investor’s income statement. Also, investing in a pro-business state can mean stream-lined construction permitting, eviction procedures, as well as laws that are designed to protect you from problematic tenants. Your intention as an investor going into a property isn’t to kick people to the curb, but at the same time, you want to be protected if tenants are trying to take advantage of you. Choosing a business-friendly market in which to invest is less about playing offense and more about the defense related to protecting your bottom line.

NOTE: These are the same indicators that we use when evaluating whether or not we should enter a new real estate market. If this overview was of value to you but you’re unsure of where to start as far as the data is concerned, feel free to reach out to us for a list of our top resources for performing this analysis. We’d be happy to recommend data sources and assist with your research however possible.