For anyone that knows Marc or Gonzalo, they can appreciate that their real estate journey has been anything but easy. As opposed to the podcast real estate moguls that start out investing and within a year have obtained millions and reached financial freedom, their story has been filled with more ups and downs than straight lines. Over the past 5 years, the guys have experienced some tough times as they navigated through their new Real Estate ventures. They learned some tough lessons doing single-family flips, BRRR’s (Buy Renovate Refinance & Repeat) that required a lot of blood, sweat, and sometimes tears that followed, and syndication deals that fell apart before closing and eventually losing tens of thousands in earnest money deposits (a few pics from these “fun times” below).

Buy, stress, lose sleep, and hold.

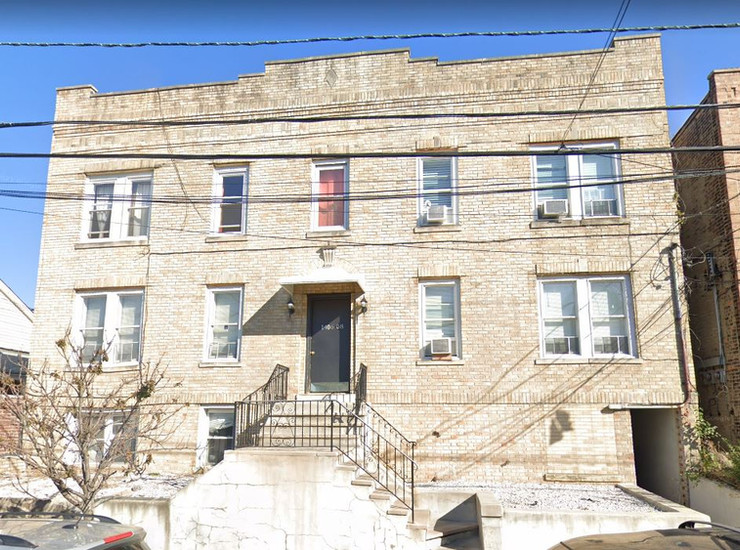

The BRRR that wasn’t to be (this is the “before” picture).

Our LP investment turned into a GP takeover.

Yet here they remain, ever determined on consistently moving forward. In fact, today they’re even more determined than ever to reach their goals through real estate. Surely something must be wrong with them mentally, right? How could it be that two individuals would willingly subject themselves to countless sleepless nights, stressful deals, problematic tenants, etc.? Sanity questions aside, it all comes back to their “WHY.” Whether it was Gonzalo selling his ownership interest in his engineering firm to try and further pursue his Real Estate ventures or Marc sleeping at a property for days on end to get the job done, they were always willing to make the bold sacrifices that it took because the alternative was even scarier.

Start With Your “Why”

For Gonzalo, his bedrock has always been his family. His wonderful wife, Kellen, and two precious little girls, Mia and Zoe, are his world. He wanted to have the freedom to spend more time with them and less energy worrying about employees and working late on large engineering projects at his firm. Further, as an immigrant who came to this country at a young age from Argentina, he appreciated the fact that ownership meant something in the US. He also saw that real estate was one of the surest ways to attain generational wealth that could someday be passed down to his children. He was doing his first flip when he met Marc back in 2016.

For Marc, he saw his father do long haul truck-driving throughout his childhood. His father would be away from home for weeks or months on end, return for a few days, and then be back on the road again. During Marc’s teenage years, his father shipped out to the Middle East as a translator with the Special Forces, where he spent the next 5 years fighting ISIS and other terrorist groups. All to provide for his family. While Marc appreciated the sacrifices that his father made (picture with Marc above), he never wanted to have to make the same choices for his family one day. On the other side of his family, Marc saw his uncles build wealth through real estate investing in the 90’s, and that served as the proof of concept. He decided to take action in 2016.

Partner With Others Who Have Similar Goals

Since they both started investing in 2016, Gonzalo and Marc have experienced countless examples of failing forward, and they have the scars to prove it. But just like with physical wounds, the scar tissue that forms after the fact is even more impenetrable. Thus, resistance creates resilience for those willing to push through it. Ray Dalio says it another way: “Pain + Reflection = Progress.” So rather than throwing in the towel when their BRRR didn’t work out… rather than giving up when they invested with the wrong sponsor… rather than calling it quits when their first syndication deal fell apart and they lost a year’s worth of savings… they chose to give those events a different meaning. They chose to treat them as “seminars” to quote the prolific Rod Khleif. Seminars which, if studied closely, they could glean invaluable information from. Information that in the coming years will no doubt pay off for them.

Where Focus Goes, Energy Flows

We realize the above is a stark departure from our normal multifamily educational content. While not educational in a technical sense, our story was meant to be more instructive from a mindset viewpoint. It’s been said that multifamily investing is 90% mindset and 10% mechanics. We hope that by being a little vulnerable and telling you a bit more about our failures seminars, you’ll see that encountering obstacles is part of the process. Don’t get us wrong though–we would’ve loved to avoid learning some of these lessons the hard way. At times, we’ve questioned ourselves, argued amongst each other, and even contemplated the q-word. However, every time the road got tough, we reminded ourselves why we’re doing it. For both of us that meant returning to family, the time we want to spend with them, and the future legacy that we’re looking to leave for them. We hope that some part of our brief story inspires you to take action in whatever you’re pursuing in spite of any past failures seminars that you’ve had to learn and the pain that they brought along with them. Remember, tough times don’t last, tough people do, and with perseverance and grit anyone can overcome failures and turn them into seminars. We’ll look to expound on the lessons we took from these experiences in future videos.